What Are Meme Coins? Why They Matter in Today’s Crypto Market

Meme coins are a curious part of the cryptocurrency world. At first glance, they seem silly—tokens based on internet jokes, cartoon dogs, or social media trends. Yet in recent years, these digital assets have grown to capture billions in market value and gained the attention of millions worldwide.

So, what are meme coins, and why are they still relevant in 2025? For beginners entering crypto, this guide unpacks their origins, mechanics, risks, and potential roles in the digital economy.

From Joke to Giant: A Short History of Meme Coins

Credit from Debut Infotech

The first and most iconic meme coin, Dogecoin (DOGE), was launched in December 2013 by Billy Markus and Jackson Palmer. It started as a lighthearted parody of Bitcoin, inspired by the popular “Doge” meme—a Shiba Inu with quirky phrases in Comic Sans.

Despite its humorous start, Dogecoin took off. Communities rallied behind it, tipping others online, funding charitable campaigns, and even sponsoring a NASCAR driver. But the real explosion happened years later, when high-profile figures like Elon Musk tweeted about it, sending prices surging and drawing in a wave of new investors.

Following Dogecoin’s success came a wave of imitators and spin-offs, each with their own meme identity. Some lasted. Most didn’t. But the trend continues.

Meme Coins vs. Traditional Cryptocurrencies

Unlike Bitcoin or Ethereum, which were designed with deep technological or financial ambitions, meme coins are usually driven by branding and social energy. They are less about solving global financial problems and more about creating viral movements.

Let’s compare some characteristics:

| Feature | Meme Coins | Traditional Cryptocurrencies |

|---|---|---|

| Purpose | Cultural or humorous; often satirical | Payments, smart contracts, DeFi, etc. |

| Community Influence | Central to project success | Important, but not primary |

| Developer Transparency | Often anonymous or minimal | Usually professional and public |

| Use Cases | Limited; sometimes added later | Core to the design |

| Price Volatility | Extremely high | Moderate to high depending on asset |

This comparison doesn’t suggest meme coins are worthless—but they serve a different purpose. Their strength lies in their ability to engage and mobilize communities rapidly, often through humor and internet trends.

Examples of Notable Meme Coins (as of 2025)

Here’s a look at some of the most discussed meme coins up to 2025, including their backgrounds and performance:

| Coin | Year Launched | Blockchain Used | Peak Market Cap | Notable Traits |

|---|---|---|---|---|

| Dogecoin | 2013 | Dogecoin native chain | ~$88B (May 2021) | First meme coin, PoW blockchain |

| Shiba Inu | 2020 | Ethereum (ERC-20) | ~$41B (Oct 2021) | DeFi, NFTs, and Shibarium ecosystem |

| Pepe Coin | 2023 | Ethereum | ~$1.8B (2023) | Inspired by “Pepe the Frog” meme |

| FLOKI | 2021 | Ethereum, BNB | ~$3.5B (2021) | Named after Elon Musk’s pet dog |

| BONK | 2022 | Solana | ~$1B (Jan 2024) | Community airdrop on Solana |

While a few of these coins have shown temporary success, many more have vanished within months. This highlights a core truth: meme coins are extremely speculative.

How Meme Coin Gain Value

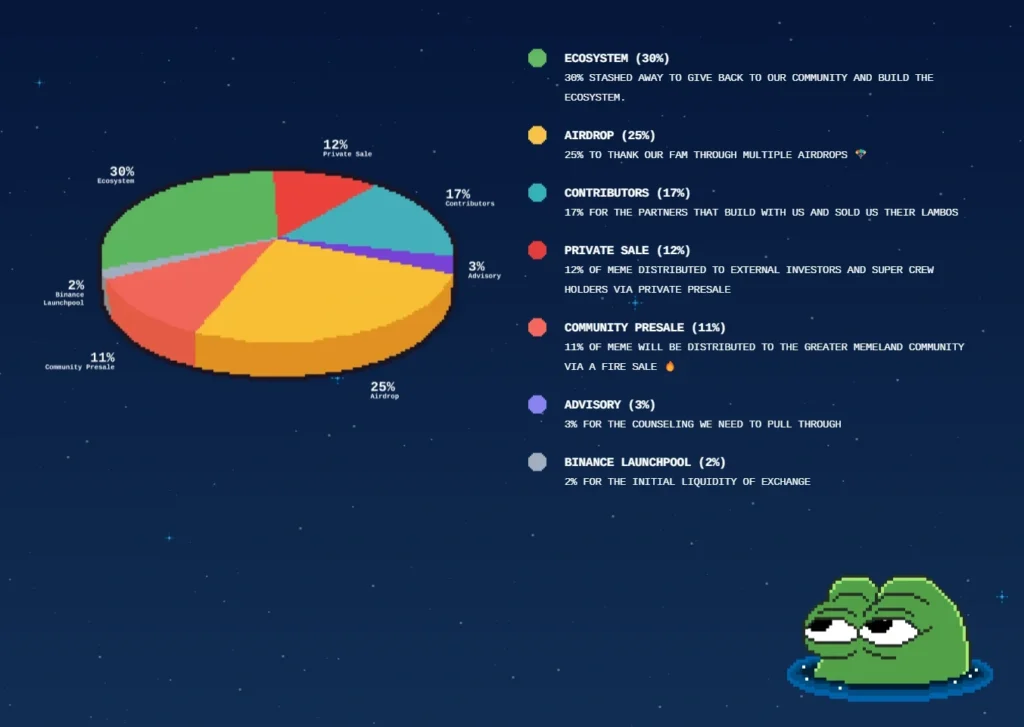

Credit from OSL

Unlike utility-focused tokens, meme coins typically rely on attention and engagement to drive price action. Their growth depends on:

- Virality on Social Media

Platforms like X (Twitter), Reddit, TikTok, and Telegram play a massive role. A trending post or influencer mention can ignite a rally. - Community-Driven Culture

Holders often promote coins through memes, videos, merchandise, and even grassroots campaigns. The more active and creative the community, the stronger the brand. - Speculation and Hype Cycles

Many investors buy early, hoping to sell when prices spike. This speculative cycle fuels both the rise and the eventual crash of many meme tokens. - Occasional Development Efforts

Some projects later introduce token burns, NFT marketplaces, or even blockchain games. However, such developments are often reactive and secondary.

Are Meme Coins a Good Investment?

Credit from Reddit

That depends on your definition of “good.”

Meme coins have made some people rich—especially those who bought early and sold at the right time. But they’ve also led to substantial losses for many who mistook virality for value.

Risks to be aware of:

- Lack of long-term utility: Many meme coins do not offer meaningful services or use cases.

- Extreme price volatility: It’s not uncommon for prices to swing 70–90% in a single week.

- Rug pulls and scams: Some coins are created by anonymous developers who vanish after raising funds.

- Over-reliance on influencers: Prices can plummet the moment public attention shifts elsewhere.

At best, meme coins may offer high-reward, high-risk speculation. At worst, they can be financial traps disguised as cultural trends.

How to Approach Meme Coin as a Beginner

If you’re curious and want to explore, do so carefully. Here are some practices to consider:

- Start with research. Look into the project’s origin, team (if public), whitepaper (if it exists), and tokenomics.

- Join the community. Engage in official Telegram or Discord channels to understand how active and genuine the support base is.

- Use secure platforms. Stick with reputable centralized exchanges or, if using a decentralized exchange (DEX), double-check contract addresses.

- Set investment limits. Only invest amounts you can afford to lose without emotional or financial stress.

- Take profits gradually. If a coin spikes in price, consider taking partial profits rather than holding until a crash.

Treat meme coins not as investments, but as speculative experiments. Curiosity is fine. Dependence is not.

The State of Meme Coins in 2025

As of this year, meme coins continue to evolve. Some projects are trying to add real utility—through decentralized applications, partnerships, or donations to social causes. For example, the Shiba Inu ecosystem now includes Shibarium, a Layer-2 network supporting DeFi applications.

Other coins like BONK are building stronger ties to NFT platforms and GameFi on Solana. Meanwhile, newer meme tokens leverage AI-generated art or celebrity branding to attract attention in saturated markets.

But despite these changes, the fundamentals remain the same: success depends heavily on marketing and timing.

Final Thoughts: Should You Get Involved?

So, what are meme coins, and should you get involved?

They are a product of internet culture, not traditional finance. They rise and fall with trends, social dynamics, and humor. They can be entertaining and even profitable—but they’re unpredictable and often unsupported by any long-term value proposition.

For new investors, meme coins can be a learning opportunity. They offer insight into crypto trading, community dynamics, and blockchain basics. But they should never replace informed investment strategies built on diversification and sound research.

Meme coin may not shape the future of finance—but they have already shaped the way we think about digital culture and the power of community in financial systems.