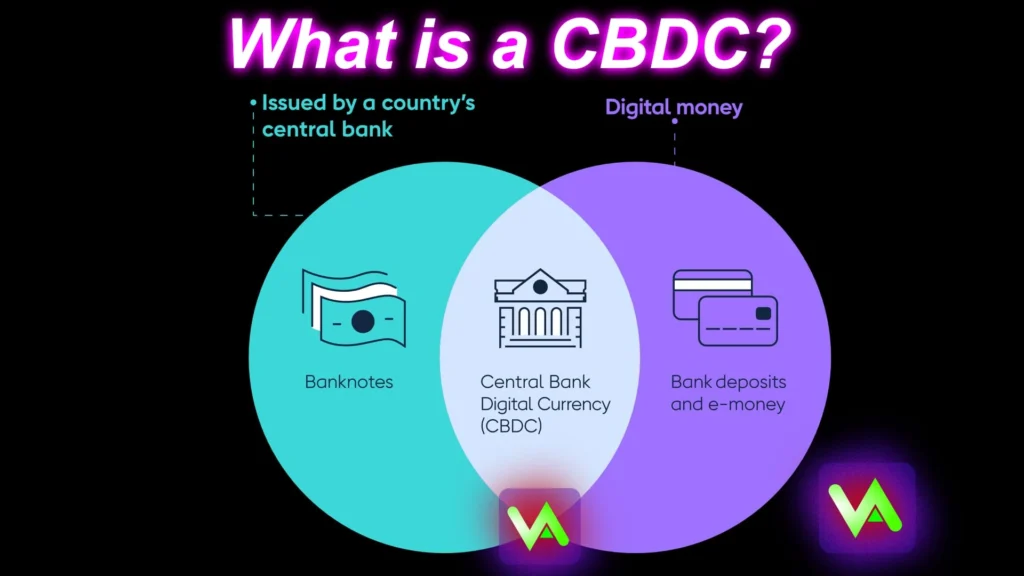

What Is a CBDC? In the rapidly evolving financial world, one concept is drawing attention from economists, governments, and technology firms alike: Central Bank Digital Currencies, or CBDCs. If you’ve heard this term but aren’t sure what it really means, you’re not alone.

This guide explains CBDCs in simple language: how they differ from cryptocurrencies, how they could impact your daily transactions, and why over 130 countries are exploring them.

What Is a CBDC?

Credit from Virtual Assets

A Central Bank Digital Currency (CBDC) is a digital version of a country’s official currency. It’s not like the money you keep in a commercial bank account, which is technically a claim on the bank. A CBDC, instead, is a direct digital liability of the central bank—the highest level of trust in a country’s monetary system.

Put another way, it’s digital cash issued by the state, designed to be used for payments, savings, and other financial activities just like physical money, but without the need for bills or coins.

How CBDCs Work in Practice

CBDCs are stored in digital wallets, which can be linked to mobile phones, smart cards, or even offline hardware devices. Unlike credit or debit cards, which are intermediated by banks or payment providers, CBDC transactions can happen peer-to-peer or through public infrastructure, depending on the system design.

Some CBDCs may be account-based, where each person has a digital account with the central bank or a partner institution. Others may be token-based, behaving more like digital cash where ownership depends on possession rather than identification.

In most pilot projects, central banks work with private entities (like commercial banks or fintechs) to distribute CBDCs while still retaining control over issuance and policy.

Retail vs Wholesale CBDC: Two Use Cases

Credit from India Today

Central banks typically design CBDCs to serve either retail or wholesale purposes.

- Retail CBDCs are for everyday public use. You could use them to pay for groceries, send money to family, or receive government benefits—all digitally.

- Wholesale CBDCs are restricted to financial institutions for interbank settlements, clearing large-value payments more efficiently.

Here’s how they compare:

| Category | Retail CBDC | Wholesale CBDC |

|---|---|---|

| Users | General public, businesses | Commercial banks, financial firms |

| Use Case | Consumer payments, remittances | Interbank transfers, reserve settlement |

| Impact Area | Financial inclusion, public spending | Payment efficiency, liquidity systems |

| Infrastructure | May run on public apps or wallets | Typically operates on closed systems |

Why Are CBDCs Being Developed?

Credit from International Monetary Fund (IMF)

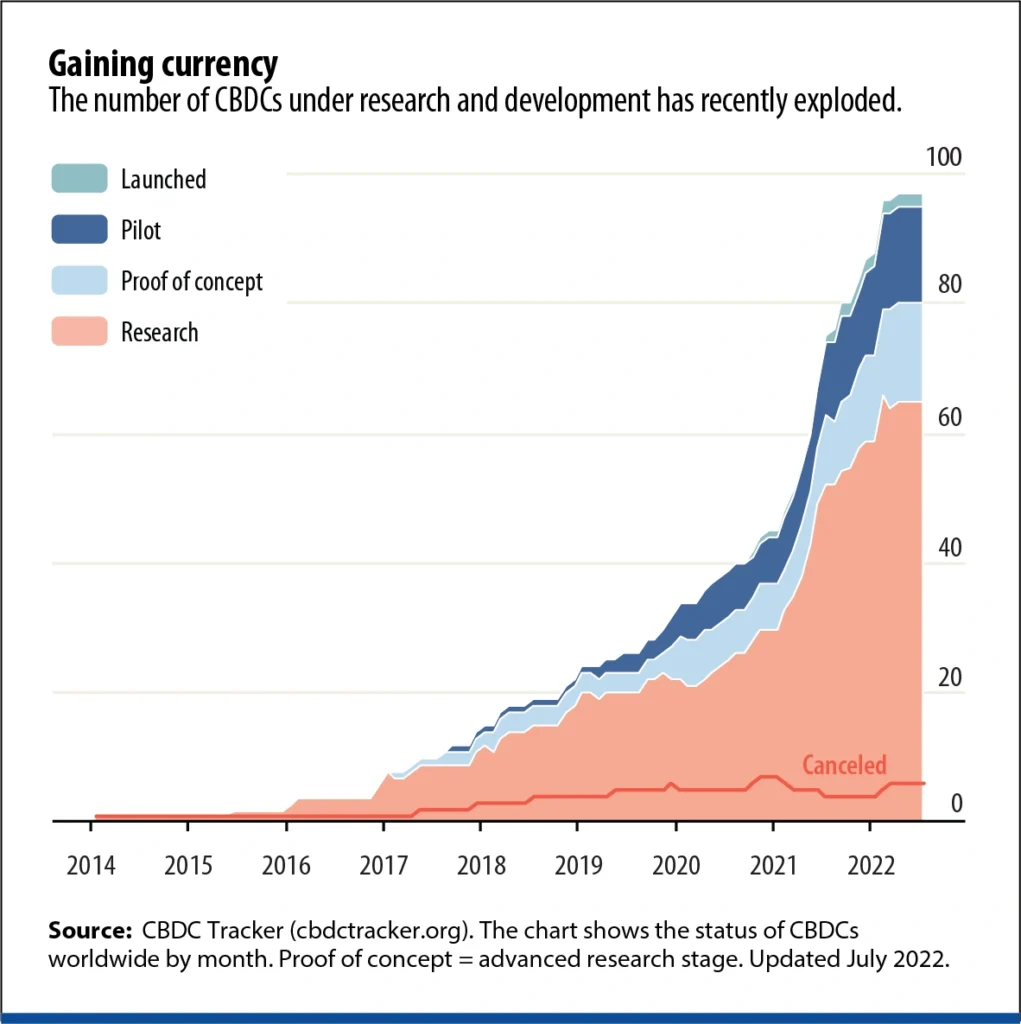

There are several reasons why central banks are exploring or building CBDCs. For many, it’s about modernizing the financial system to keep up with digital change. But deeper motivations vary by country.

- Financial Inclusion

In countries where banking access is limited, CBDCs can help citizens store and transfer money safely with just a mobile phone—no bank account required. - Improved Payment Systems

CBDCs can make transactions faster, especially across borders. Reducing fees and delays helps businesses and migrant workers alike. - Digital Alternatives to Cash

As more people go cashless, CBDCs can ensure the government still provides a public payment option—not just leave it to private tech companies. - Support for Policy Tools

Central banks can use CBDCs to deliver stimulus payments directly or manage interest rates more dynamically if the CBDC is interest-bearing. - Reduce Crime and Fraud

Because CBDCs are traceable, they may reduce illegal activities like tax evasion or money laundering—though this also raises concerns about surveillance.

How CBDCs Differ from Cryptocurrencies

While both CBDCs and cryptocurrencies are digital, the comparison stops there. One is a government instrument; the other is typically decentralized and private.

| Feature | CBDC | Cryptocurrency |

|---|---|---|

| Issuer | Central bank (government) | Decentralized networks (e.g. Bitcoin) |

| Regulation | Strictly regulated by state | Often unregulated or semi-regulated |

| Stability | Pegged to national currency (stable) | Market-driven (can be volatile) |

| Purpose | Public payment system | Investment, speculation, innovation |

| Technology | May use blockchain or central databases | Always blockchain-based |

So, while cryptocurrencies aim to bypass traditional finance, CBDCs aim to modernize it from within.

Countries Leading the Way

Over 130 countries are actively researching or developing CBDCs. Some are running live projects, while others are in pilot or early research stages.

Notable Examples:

- The Bahamas: Launched the Sand Dollar in 2020, the world’s first live CBDC.

- Nigeria: Introduced the eNaira in 2021 to encourage digital payments and inclusion.

- China: Conducting widespread pilot tests of the Digital Yuan across multiple cities.

- Jamaica: Launched JAM-DEX in 2022 to simplify digital access for its citizens.

- European Union: Developing a Digital Euro, with design and legal frameworks under review.

- United States: The Federal Reserve is in the research phase, analyzing privacy and monetary impacts.

Potential Challenges and Risks

CBDCs offer many benefits, but they also introduce new challenges—technical, economic, and ethical.

- Privacy Concerns

Some fear that CBDCs could give governments too much control over individual spending data. Balancing traceability and anonymity is a major design debate. - Banking Disruption

If people shift deposits from commercial banks into central bank wallets, it could reduce banks’ ability to lend, potentially affecting interest rates and credit access. - Cybersecurity

A CBDC platform must be robust against hacking, outages, and operational failures. Unlike cash, which works without power, digital currencies require infrastructure. - Adoption Hurdles

In regions with low internet access or digital literacy, CBDCs may struggle to replace cash. - International Coordination

If countries design incompatible CBDC systems, cross-border transactions may remain expensive or inefficient.

These risks mean that most central banks are moving cautiously, often involving public consultations and phased rollouts.

What CBDCs Could Mean for You

If adopted widely, CBDCs might change how we interact with money. You could receive your tax refund directly into a government-issued wallet. Making payments across countries could become as simple as sending a text. Even shopping might feel different—digital currency could be transferred without going through a bank or credit card network.

But it also means your digital wallet may become part of a larger economic infrastructure controlled by the state. The benefits of convenience and inclusion must be weighed against concerns about privacy, control, and access.

Conclusion: What Is a CBDC and Why Understanding CBDCs Matters

As economies move deeper into the digital age, the idea of money itself is evolving. CBDCs offer a new model—digital, central, and public. Unlike cryptocurrencies, which challenge central banks, CBDCs reinforce them with modern tools and expanded reach.

Knowing what a CBDC is helps you prepare for a financial future where governments and citizens interact through secure digital platforms instead of just physical bills or commercial banks.

Whether these systems become widespread or remain experimental depends on how effectively central banks can balance technology, trust, and transparency. But the conversation is no longer theoretical. It’s already underway—and the impact could reshape the foundation of global finance.