The search for a good crypto exchange often feels endless, but WhiteBIT has been steadily gaining attention among traders in 2025. In this WhiteBIT Exchange Review, I’ll share what the platform offers today, how much it really costs to trade here, and whether it feels safe enough for everyday use.

WhiteBIT Exchange Review – What It’s Like to Get Started

Credit From: Whitebit

Setting up my account on WhiteBIT was painless. The registration form is quick, and KYC didn’t drag on for days—it was done within hours. The layout is simple and doesn’t throw too much information at you all at once, which makes it beginner-friendly.

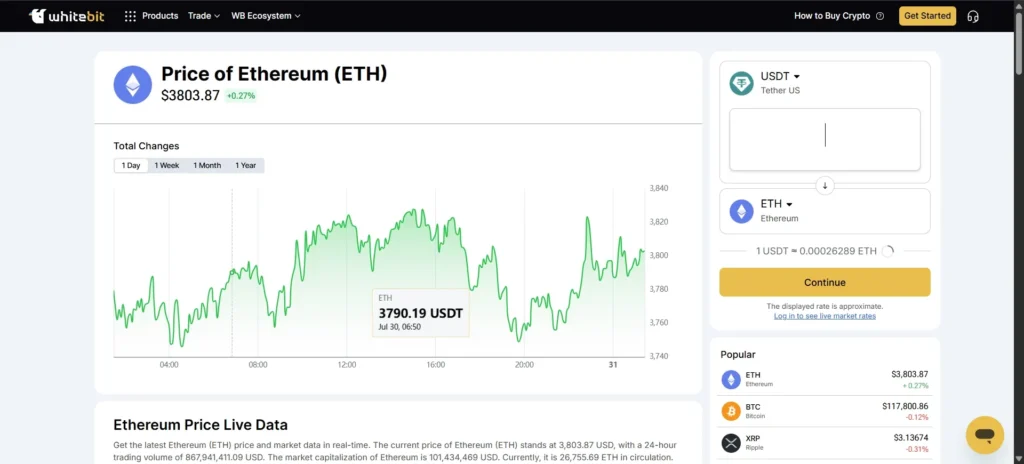

I placed a few spot trades as a test. Orders on major pairs like ETH/USDT executed smoothly without slippage beyond what I’d expect in a volatile market. For a mid-sized exchange, execution speed was better than I anticipated.

Features That Define WhiteBIT in 2025

Credit From: blog.whitebit

WhiteBIT supports a wide selection of coins, from household names like Bitcoin and Solana to smaller tokens for niche traders. Both spot and futures markets are available, with leverage options that won’t scare away moderate-risk traders.

I’ve also used their mobile app extensively this month. It’s not overloaded with complicated options, but it gives you exactly what you need to trade on the go. Placing and canceling orders, checking balances, and making transfers are fast and hassle-free.

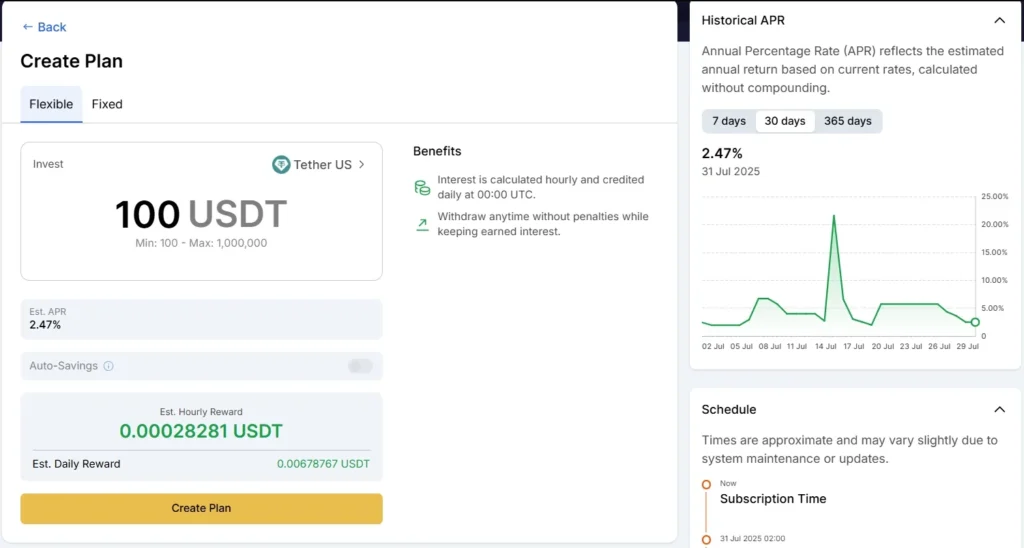

WhiteBIT Exchange Review – Updated Fees for 2025

Credit From: cryptonews

One area where WhiteBIT keeps things competitive is fees. Most trades start at 0.1%, which is lower than many smaller exchanges I’ve tried. The tiered system rewards active traders by gradually lowering fees as your volume increases.

| Level | Maker Fee | Taker Fee |

|---|---|---|

| Level 1 | 0.0100% | 0.0550% |

| Level 2 | 0.0060% | 0.0540% |

| Level 3 | 0.0040% | 0.0535% |

| Level 4 | 0.0030% | 0.0530% |

| Level 5 | 0.0020% | 0.0525% |

| Level 6+ | 0.0010% → 0.0000% | 0.0520% → 0.0350% |

Deposit fees are free for most cryptocurrencies, and withdrawal costs are on par with market averages. In my case, moving funds out took just a few minutes to process.

Security and Reliability of WhiteBIT Exchange

Security has become a deciding factor for many traders, myself included. WhiteBIT claims 96% of assets are stored offline in cold wallets, and 2FA is required for any withdrawals. While no exchange is immune to risk, my experience with logins, transfers, and withdrawals has been smooth and incident-free.

WhiteBIT hasn’t faced any major security breaches so far, which gives traders more confidence in its reliability as a mid-tier exchange.

Pros and Cons of WhiteBIT in 2025

| Pros | Cons |

|---|---|

| Low fees with discounts for high-volume traders | Fewer advanced features than top-tier competitors |

| Quick sign-up and easy navigation | Lower liquidity on some smaller tokens |

| Responsive mobile app for trading on the go | Fiat withdrawal options limited by region |

| Strong focus on security measures | Not available in every jurisdiction |

For casual traders or those who just want a straightforward platform, these drawbacks are not deal-breakers. If you need deeper liquidity or advanced charting tools, you may need to complement WhiteBIT with another platform.

Final Verdict: Is WhiteBIT Exchange Right for You?

Based on this WhiteBIT Exchange Review, I’d say the platform is a strong option in 2025 for most retail traders. It’s simple, affordable, and doesn’t compromise on essential security features.

If you’re looking for an exchange that’s easy to start with, handles trades quickly, and won’t eat into your profits with high fees, WhiteBIT is worth trying. Just be aware of its limits on niche markets and advanced features if you’re a pro-level trader.