Ethereum: The Engine Behind the World’s Second-Largest Cryptocurrency

Ethereum is widely known as the world’s second-largest cryptocurrency by market value—right after Bitcoin. But to define Ethereum solely by its price would miss the point. Ethereum isn’t just another digital coin; it’s a platform, a technology, and increasingly, a foundation for how decentralized systems are being built.

Launched in 2015 by Vitalik Buterin and a group of developers, Ethereum was designed not just to handle peer-to-peer transactions, but also to execute smart contracts—self-executing agreements with rules written in code. These contracts run on the Ethereum blockchain, which acts as a decentralized global computer.

While Bitcoin is often compared to digital gold, Ethereum is more like a programmable internet. And that difference is key to understanding its real value.

Ethereum 101: Learn Ethereum Basics Without the Jargon

Credit from Money

For beginners, it’s helpful to think of Ethereum as having two parts: Ether (ETH), the cryptocurrency used for transactions and fees, and the Ethereum network, which enables decentralized applications (dApps), NFTs, DeFi (decentralized finance), and more.

If you’ve ever wondered how people buy digital art on OpenSea or borrow cryptocurrencies without a bank, chances are they’re using Ethereum in the background. Each action—whether minting an NFT or swapping coins on a decentralized exchange—relies on smart contracts executed automatically on the Ethereum network.

At the core of Ethereum’s design is transparency. All transactions and applications on the blockchain are visible and traceable, yet they operate without intermediaries. This makes Ethereum both a tool of freedom and a challenge to traditional financial systems.

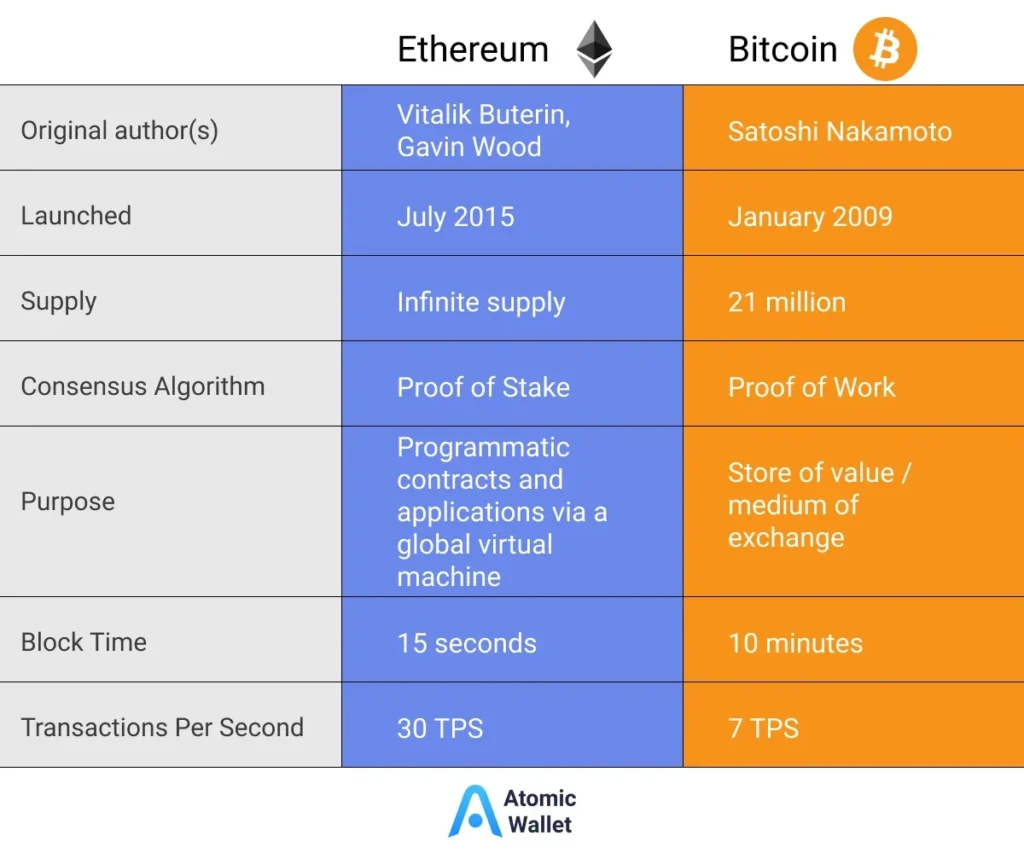

Ethereum vs Bitcoin: Key Differences Every Beginner Should Know

Credit from Atomic Wallet

Both Ethereum and Bitcoin use blockchain technology, but they serve different purposes. Bitcoin is primarily a store of value—a hedge against inflation. Ethereum, on the other hand, was built as a platform for building decentralized applications.

Here are a few ways they differ:

- Functionality: Bitcoin is focused on money transfers; Ethereum is programmable.

- Speed: Ethereum transactions tend to process faster than Bitcoin’s.

- Smart Contracts: Unique to Ethereum, these allow for the creation of dApps, games, DAOs, and more.

Because of its versatility, Ethereum is often referred to as the foundation of Web3—a new vision of the internet centered on user ownership and decentralization.

Buying Ethereum Safely: A Beginner-Friendly Guide

Getting started with Ethereum doesn’t have to be intimidating. If you’re new, follow these basic steps:

- Choose a secure exchange (e.g., Coinbase, Binance, Kraken) and set up two-factor authentication.

- Buy Ether (ETH) using fiat currency like USD, MYR, or EUR.

- Transfer ETH to a wallet—hardware wallets like Ledger or Trezor offer more protection than keeping coins on an exchange.

Also consider learning about gas fees, which are small transaction fees paid in ETH. These can vary depending on network congestion.

If you plan to hold Ethereum long term, research cold storage options and avoid sharing private keys or seed phrases with anyone. Crypto is powerful, but it places the responsibility of security directly in the user’s hands.

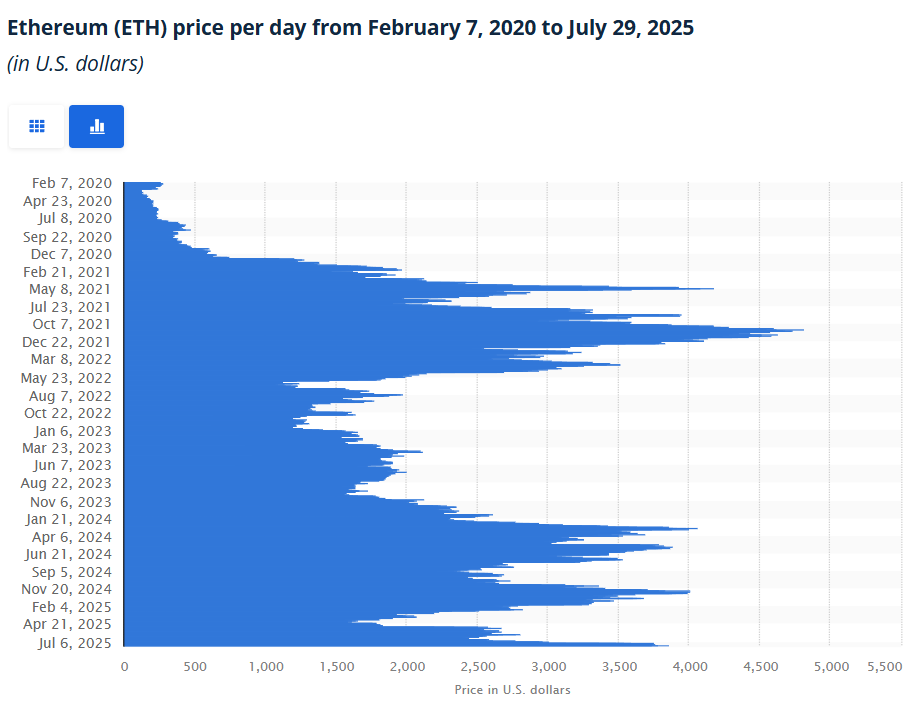

How Ethereum is Powering the Future of Decentralized Technology

Credit from Statista

Ethereum’s impact is already visible. It’s at the heart of DeFi, where users borrow, lend, or earn interest without banks. It supports NFT platforms, where creators can sell digital goods directly to buyers. It even powers decentralized autonomous organizations (DAOs), where communities govern themselves using code.

Looking forward, Ethereum is still evolving. The recent upgrade to Ethereum 2.0 brought proof-of-stake consensus, which reduces energy consumption drastically. It’s part of an ongoing transformation that makes the network faster, greener, and more scalable.

Conclusion on Ethereum, the world’s second-largest cryptocurrency

Ethereum may be the world’s second-largest cryptocurrency, but its significance reaches far beyond market cap. For anyone curious about the future of finance, technology, or the internet itself, learning Ethereum basics is no longer optional—it’s essential.