Introduction: Crypto Custody Explained

Crypto custody explained in simple terms: it is about who holds and protects the private keys that unlock your cryptocurrency. For beginners entering the digital asset market, custody is not just a technical matter — it is the foundation of security, control, and long-term trust in the system.

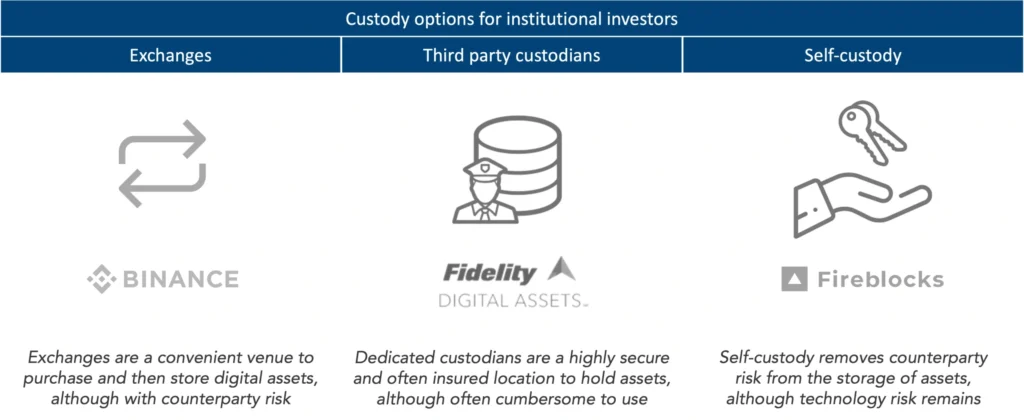

There are two primary ways to manage custody: self-custody (you hold the keys) and third-party custody (a company or exchange holds them for you). Each approach carries distinct responsibilities, risks, and benefits. This article explores both paths, highlights best practices, and offers guidance for newcomers deciding how to store crypto safely.

Why Custody Matters in Crypto

Unlike traditional banking, cryptocurrency has no central authority guaranteeing account recovery. Losing a private key is often equivalent to losing the money itself. According to Chainalysis, over 3.7 million Bitcoin (worth more than $200 billion at 2025 market prices) is estimated to be permanently lost due to forgotten passwords or misplaced keys.

This statistic highlights why custody solutions matter. Whether you choose a do-it-yourself route or a professional custodian, the goal is the same: to protect your crypto assets from theft, loss, and unauthorized access.

Understanding Self-Custody

Credit from Pintu

Self-custody means you hold the private keys yourself, often through software wallets, hardware wallets, or paper backups. The phrase “not your keys, not your coins” captures the philosophy behind this approach.

Key Features of Self-Custody

- Direct Ownership: You are the only person with access to your funds.

- Decentralized Control: No bank or service provider stands between you and the blockchain.

- Greater Responsibility: You must secure backups and protect against human error.

Advantages

- Privacy and Independence: Transactions do not require sharing personal data with third parties.

- Freedom from Platform Risk: No reliance on exchanges that might be hacked or shut down.

- Long-Term Security: Properly stored hardware wallets can protect assets for decades.

Challenges

- Human Error: Lost seed phrases or damaged devices often result in irreversible loss.

- Complex Setup: Beginners may find wallet software, backups, and security procedures intimidating.

- No Customer Support: If something goes wrong, there is no one to call.

Third-Party Custody Explained

Credit from CMCC Global

Third-party custody transfers the responsibility of holding private keys to a company — often exchanges, custodial wallet providers, or regulated institutions. Think of it like depositing money in a bank, where the institution safeguards it on your behalf.

Benefits of Third-Party Custody

- Convenience: User-friendly platforms make it easy to buy, sell, and transfer crypto.

- Professional Security Measures: Custodians often use cold storage, multi-signature approvals, and even insurance coverage.

- Account Recovery Options: Unlike self-custody, forgotten passwords or misplaced credentials can usually be reset.

Risks

- Counterparty Risk: Your assets are only as safe as the custodian’s financial health and security systems. The collapse of FTX in 2022 is a cautionary tale, where billions in user funds were locked or lost.

- Regulatory Exposure: Governments may freeze accounts or impose restrictions.

- Privacy Trade-Offs: KYC (Know Your Customer) checks mean your identity is tied to transactions.

Comparing the Two Approaches

The best way to illustrate the differences between self-custody and third-party services is through a side-by-side comparison.

| Aspect | Self-Custody | Third-Party Custody |

|---|---|---|

| Control | Full control over private keys | Custodian manages keys on your behalf |

| Security | Depends on personal discipline & devices | Professional systems, but vulnerable to hacks |

| Ease of Use | Steeper learning curve | Beginner-friendly, intuitive interfaces |

| Privacy | Higher, no identity sharing required | Lower, due to KYC and data collection |

| Recovery Options | None if keys are lost | Account recovery usually available |

| Counterparty Risk | None | Present (service provider dependency) |

| Cost | Hardware wallets can cost $70–$200 | Fees may apply for custody or withdrawals |

Crypto Custody Real-World Examples:

- Self-Custody Tools:

Hardware wallets such as Ledger Nano X or Trezor Model T are widely used for offline, secure storage. - Third-Party Custodians:

Coinbase Custody (regulated in the U.S.) and BitGo are examples of institutional-grade custodians offering insurance and compliance features.

These examples illustrate that both paths are established, and millions of users already rely on them depending on their needs.

Best Practices for Crypto Custody

Whichever approach you choose, security practices are essential. A few practical tips include:

- Diversify Custody Methods

Don’t keep all assets in a single wallet or with one custodian. A mix reduces single-point failure risks. - Use Cold Storage for Long-Term Assets

For holdings you rarely trade, hardware wallets or cold storage vaults remain the safest. - Stay Updated on Threats

Cybercrime tactics evolve constantly. Follow security news and update wallet software regularly. - Two-Factor Authentication (2FA)

For custodial platforms, always enable 2FA to reduce account takeover risks. - Secure Your Recovery Phrases

Store seed phrases offline, ideally in multiple secure physical locations.

Which Option Suits Beginners?

- If you value simplicity and quick access: Third-party services may feel safer at first. Many newcomers start here to learn the basics before moving to self-custody.

- If you prioritize sovereignty and privacy: Self-custody is ideal, but only if you are ready to take responsibility for protecting your keys.

In reality, many investors use a hybrid approach — small amounts in third-party wallets for trading convenience, and the bulk in hardware wallets for long-term protection.

Conclusion: Crypto Custody Explained

Credit from CCN.com

Crypto custody explained simply: it is the balance between convenience and control. Self-custody empowers users with full ownership but demands responsibility. Third-party services lower the technical barrier but introduce counterparty and regulatory risks.

For beginners, the right choice depends on personal comfort with technology, security discipline, and financial goals. By adopting best practices and staying aware of custody options, you can protect your digital assets and navigate this new financial frontier with greater confidence.